Real Estate Transfer Tax Exemptions Maine . the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. there are certain exemptions. maine imposes a tax on certain transfers of real property located in the state. A taxable transfer can occur either through a transfer. Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). The rate of the tax is $2.20 for each $500 or. Users to create and electronically file rett. the real estate transfer tax (rett) database is an electronic database that allows: The following are exempt from the tax imposed by this. a tax is imposed on each deed by which any real property in this state is transferred.

from www.formsbank.com

The rate of the tax is $2.20 for each $500 or. Users to create and electronically file rett. the real estate transfer tax (rett) database is an electronic database that allows: there are certain exemptions. Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). maine imposes a tax on certain transfers of real property located in the state. A taxable transfer can occur either through a transfer. The following are exempt from the tax imposed by this. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. a tax is imposed on each deed by which any real property in this state is transferred.

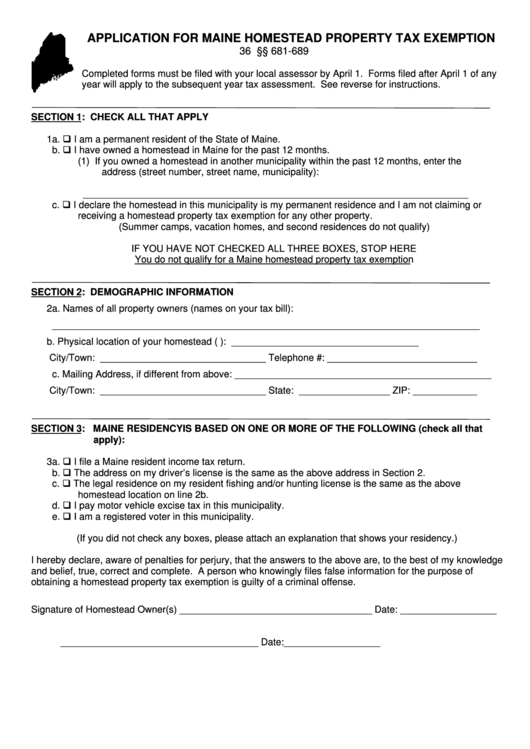

Fillable Application Form For Maine Homestead Property Tax Exemption

Real Estate Transfer Tax Exemptions Maine the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. the real estate transfer tax (rett) database is an electronic database that allows: A taxable transfer can occur either through a transfer. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. Users to create and electronically file rett. The following are exempt from the tax imposed by this. The rate of the tax is $2.20 for each $500 or. a tax is imposed on each deed by which any real property in this state is transferred. Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). there are certain exemptions. maine imposes a tax on certain transfers of real property located in the state.

From www.leowilkrealestate.com

Family Property Tax Transfer Exemptions Key Criteria Real Estate Transfer Tax Exemptions Maine The rate of the tax is $2.20 for each $500 or. maine imposes a tax on certain transfers of real property located in the state. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. a tax is imposed on each deed by which any real property in. Real Estate Transfer Tax Exemptions Maine.

From www.templateroller.com

Maine Homestead Property Tax Exemption Application for Cooperative Real Estate Transfer Tax Exemptions Maine Users to create and electronically file rett. the real estate transfer tax (rett) database is an electronic database that allows: A taxable transfer can occur either through a transfer. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. there are certain exemptions. a tax is imposed. Real Estate Transfer Tax Exemptions Maine.

From www.templateroller.com

Maine Property Tax Exemption Application for Veterans of the Armed Real Estate Transfer Tax Exemptions Maine maine imposes a tax on certain transfers of real property located in the state. there are certain exemptions. The following are exempt from the tax imposed by this. A taxable transfer can occur either through a transfer. Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). Users to. Real Estate Transfer Tax Exemptions Maine.

From www.pdffiller.com

MAINE REAL ESTATE TRANSFER TAX DECLARATION 00 RETTD Doc Template Real Estate Transfer Tax Exemptions Maine maine imposes a tax on certain transfers of real property located in the state. Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). the real estate transfer tax (rett) database is an electronic database that allows: the property tax division administers the real estate transfer tax, commercial. Real Estate Transfer Tax Exemptions Maine.

From redtreeteam.com

Save 100s of dollars on your Property Taxes Maine Homestead Real Estate Transfer Tax Exemptions Maine a tax is imposed on each deed by which any real property in this state is transferred. The following are exempt from the tax imposed by this. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. Users to create and electronically file rett. A taxable transfer can occur. Real Estate Transfer Tax Exemptions Maine.

From exozgttzj.blob.core.windows.net

Property Transfer Tax By Country at William Reser blog Real Estate Transfer Tax Exemptions Maine Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). The rate of the tax is $2.20 for each $500 or. Users to create and electronically file rett. there are certain exemptions. a tax is imposed on each deed by which any real property in this state is transferred.. Real Estate Transfer Tax Exemptions Maine.

From www.formsbank.com

Form Rew5 Request For Exemption Or Reduction In Withholding Of Maine Real Estate Transfer Tax Exemptions Maine the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. maine imposes a tax on certain transfers of real property located in the state. A taxable transfer can occur either through a transfer. The rate of the tax is $2.20 for each $500 or. there are certain exemptions.. Real Estate Transfer Tax Exemptions Maine.

From www.templateroller.com

Maine Real Estate Transfer Tax Affidavit for Assigned Rights to a Real Estate Transfer Tax Exemptions Maine there are certain exemptions. A taxable transfer can occur either through a transfer. the real estate transfer tax (rett) database is an electronic database that allows: a tax is imposed on each deed by which any real property in this state is transferred. The rate of the tax is $2.20 for each $500 or. maine imposes. Real Estate Transfer Tax Exemptions Maine.

From www.scribd.com

Generally, Any RealEstate Transfer Exceeding 100 in Value Within Real Estate Transfer Tax Exemptions Maine a tax is imposed on each deed by which any real property in this state is transferred. there are certain exemptions. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. the real estate transfer tax (rett) database is an electronic database that allows: maine imposes. Real Estate Transfer Tax Exemptions Maine.

From www.templateroller.com

Maine Application for Maine Homestead Property Tax Exemption Fill Out Real Estate Transfer Tax Exemptions Maine maine imposes a tax on certain transfers of real property located in the state. there are certain exemptions. A taxable transfer can occur either through a transfer. Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). a tax is imposed on each deed by which any real. Real Estate Transfer Tax Exemptions Maine.

From www.pdffiller.com

Fillable Online Property transfer tax exemptions Province of British Real Estate Transfer Tax Exemptions Maine maine imposes a tax on certain transfers of real property located in the state. Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). Users to create and electronically file rett. A taxable transfer can occur either through a transfer. the property tax division administers the real estate transfer. Real Estate Transfer Tax Exemptions Maine.

From listwithclever.com

Maine Real Estate Transfer Taxes An InDepth Guide Real Estate Transfer Tax Exemptions Maine Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). The rate of the tax is $2.20 for each $500 or. A taxable transfer can occur either through a transfer. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. . Real Estate Transfer Tax Exemptions Maine.

From www.pdffiller.com

Fillable Online Maine Real Estate Transfer Tax Form Pdf Fax Email Print Real Estate Transfer Tax Exemptions Maine The following are exempt from the tax imposed by this. the real estate transfer tax (rett) database is an electronic database that allows: maine imposes a tax on certain transfers of real property located in the state. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. A. Real Estate Transfer Tax Exemptions Maine.

From www.templateroller.com

Form REW5 Download Fillable PDF or Fill Online Request for Exemption Real Estate Transfer Tax Exemptions Maine maine imposes a tax on certain transfers of real property located in the state. The rate of the tax is $2.20 for each $500 or. Users to create and electronically file rett. a tax is imposed on each deed by which any real property in this state is transferred. the real estate transfer tax (rett) database is. Real Estate Transfer Tax Exemptions Maine.

From medium.com

Navigating the New Era of Home Buying in BC A Guide to Updated Real Estate Transfer Tax Exemptions Maine The rate of the tax is $2.20 for each $500 or. A taxable transfer can occur either through a transfer. Users to create and electronically file rett. maine imposes a tax on certain transfers of real property located in the state. there are certain exemptions. The following are exempt from the tax imposed by this. the real. Real Estate Transfer Tax Exemptions Maine.

From cubelaw.ca

How Will the New Property Transfer Tax Exemptions Starting April 1 Real Estate Transfer Tax Exemptions Maine The rate of the tax is $2.20 for each $500 or. a tax is imposed on each deed by which any real property in this state is transferred. Users to create and electronically file rett. there are certain exemptions. A taxable transfer can occur either through a transfer. the real estate transfer tax (rett) database is an. Real Estate Transfer Tax Exemptions Maine.

From www.templateroller.com

Maine Homestead Property Tax Exemption Application for Cooperative Real Estate Transfer Tax Exemptions Maine maine imposes a tax on certain transfers of real property located in the state. the real estate transfer tax (rett) database is an electronic database that allows: The rate of the tax is $2.20 for each $500 or. the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and.. Real Estate Transfer Tax Exemptions Maine.

From mooersrealty.com

The Property Taxes On My Maine Real Estate Assessed Value, The Real Estate Transfer Tax Exemptions Maine Of the total tax, 50% is imposed on the grantor (seller) and 50% is imposed on the grantee (purchaser). the property tax division administers the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and. Users to create and electronically file rett. there are certain exemptions. The rate of the tax is $2.20 for each. Real Estate Transfer Tax Exemptions Maine.